Capital Modeling

Why Do Companies Use Capital Models?

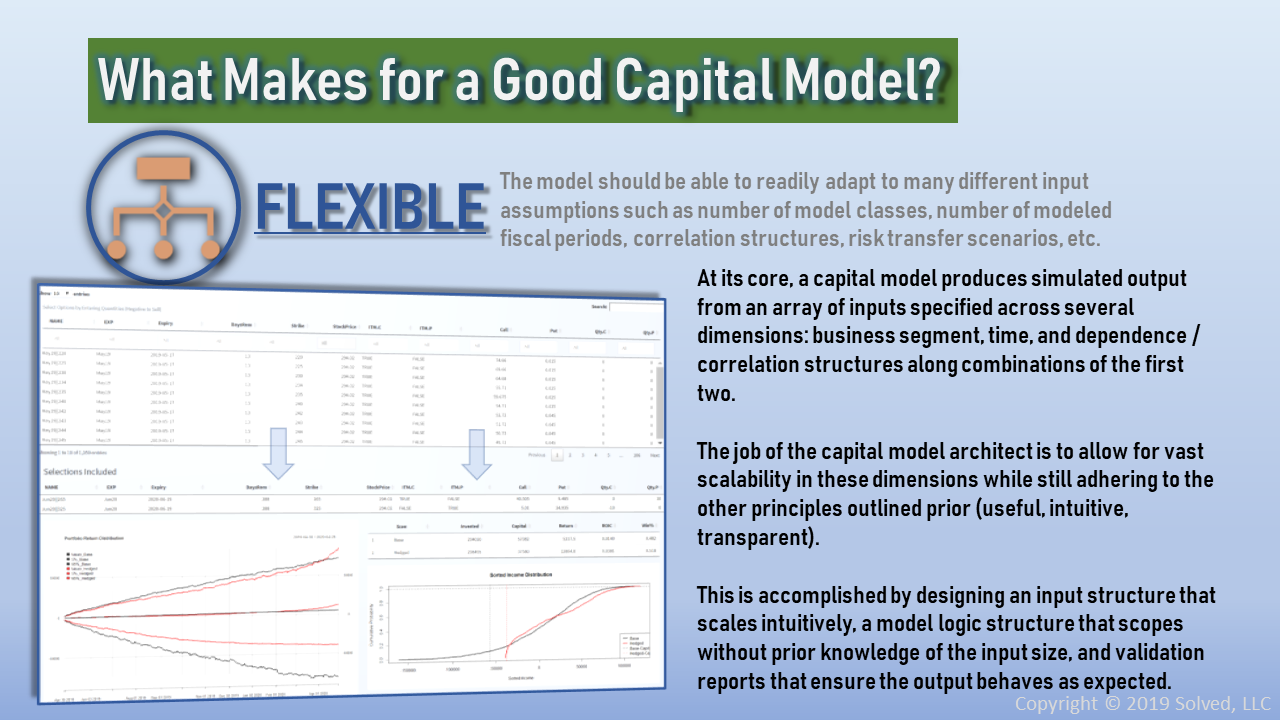

(“What Makes for a Good Capital Model?” below)

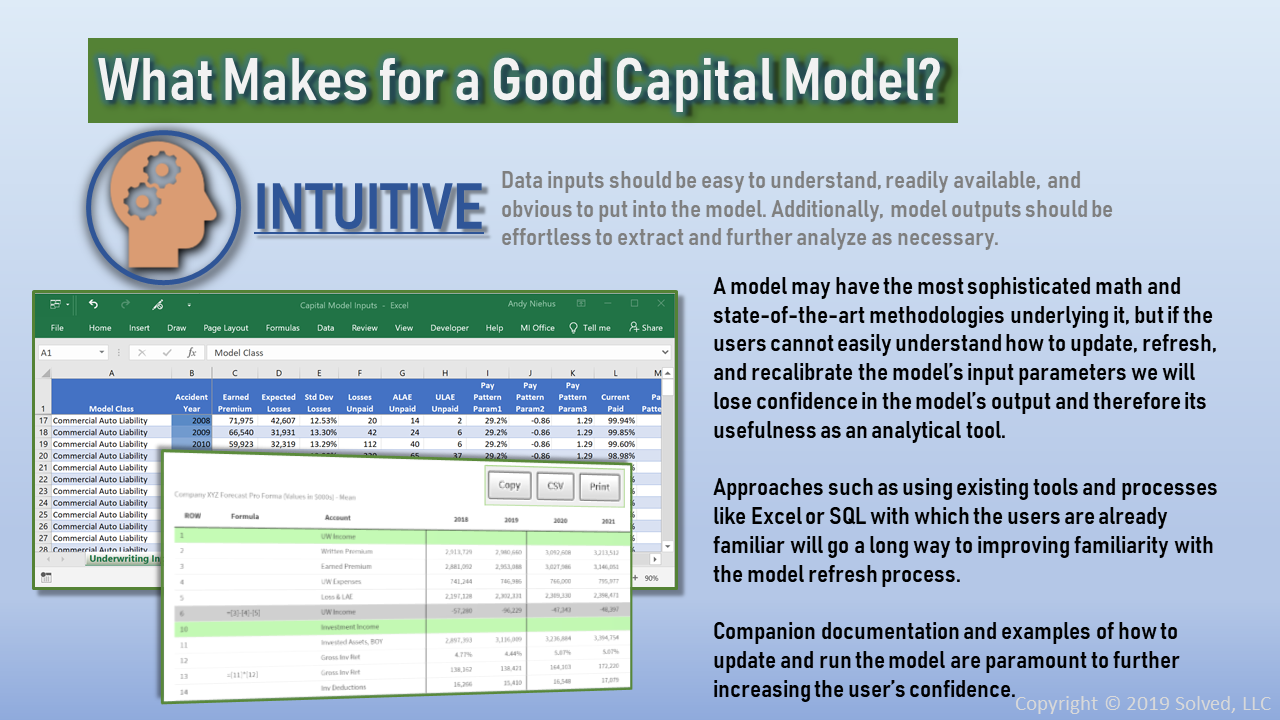

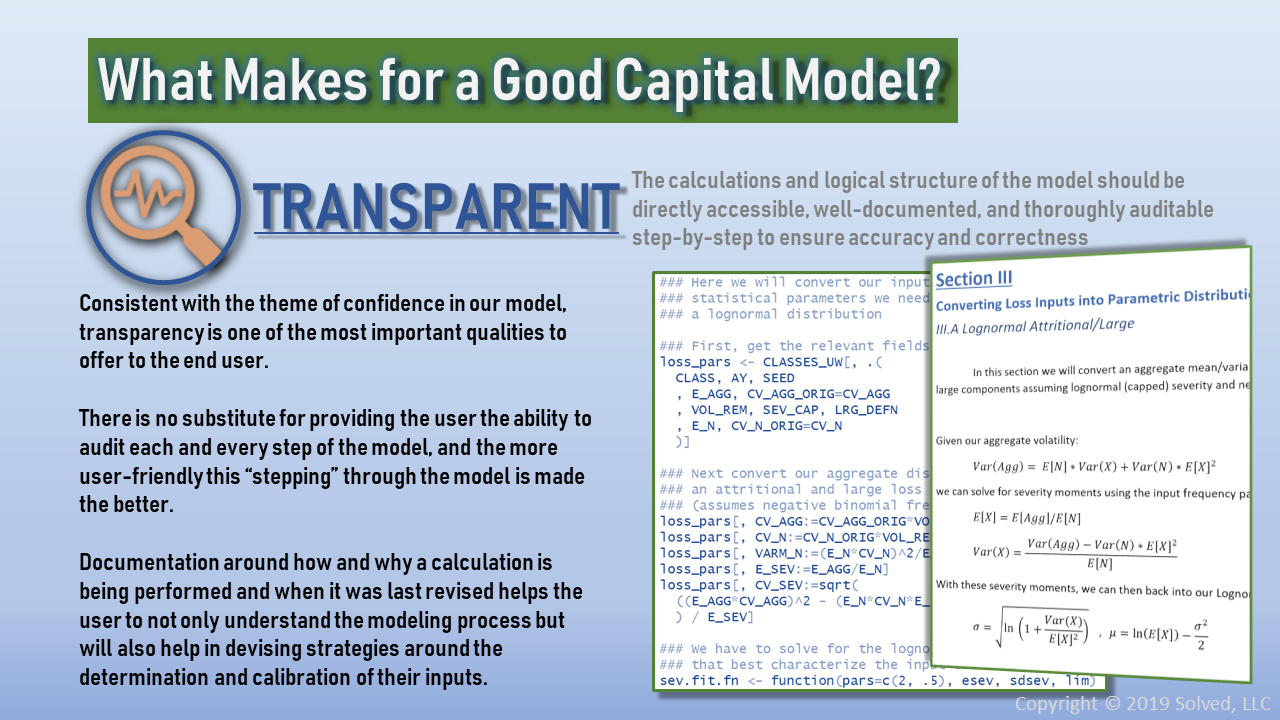

Implemented correctly, a capital model is the single most powerful tool for steering an enterprise’s strategic vision. Through the collaboration and unification of the analytical efforts of each business unit, a capital model encapsulates the grand picture of the business—income and loss, direction and deviation, risk and return—and provides the framework to analyze and assess the forecast efficacy of tactical and strategic decisions before they are executed.

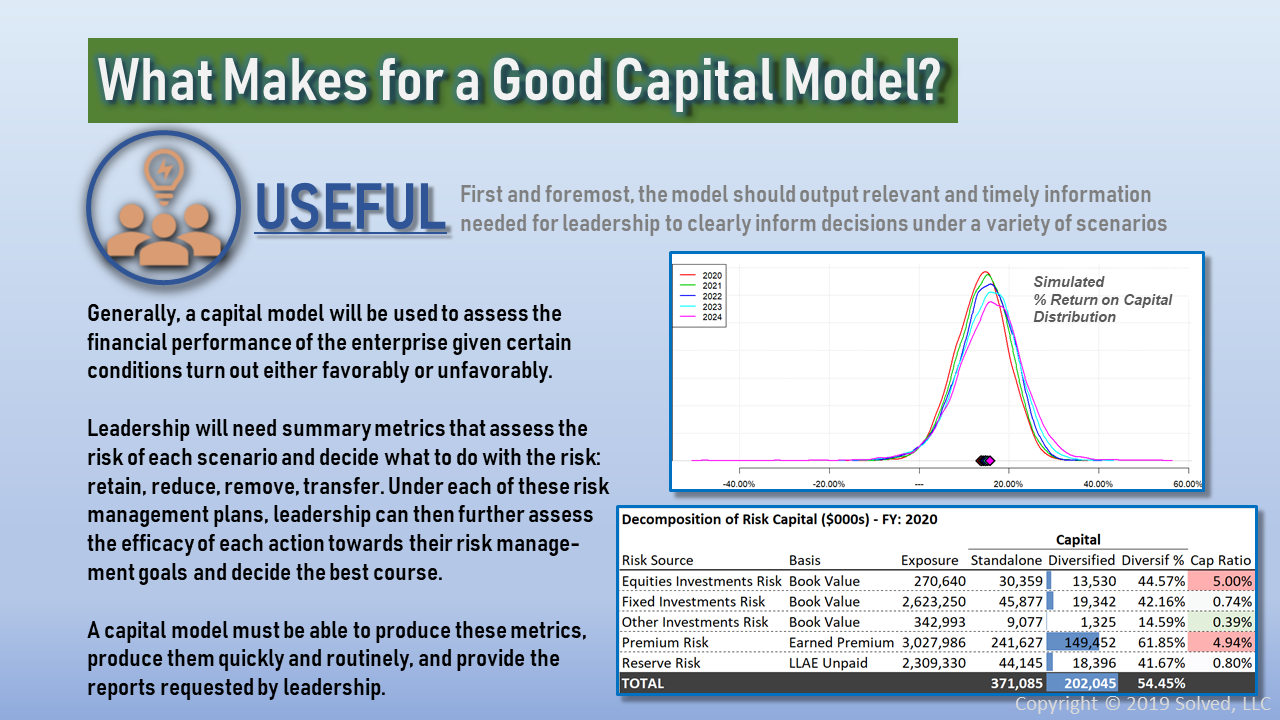

Capital models are at once used to estimate the earnings or surplus at risk for a company. In the insurance and financial industries, these models are critical instruments in providing both internal and external guidance pertaining to a company’s balance sheet strength and solvency at large. This exercise also presents the means to allocate risk capital to the contributing business units which consequently offers the ability to assess and re-calibrate the risk-adjusted performance of different products or investments—a vital analysis that ensures the long-term success of the enterprise.

Capital models are also the instrument of choice in evaluating risk management strategies. After identifying and including a quantification of these risks in a capital model, the management decision to either retain, reduce, remove, or transfer the risk becomes a much less ambiguous choice as modeled results can provide a clear representation of their effectiveness. Common applications in this arena would include reinsurance and other risk transfer analysis, investment and hedging optimization, mergers and acquisitions evaluations, and product or geographic entries and exits, among others.

Solved recognizes and certainly encourages the importance of capital models. We would love to assist your company in ensuring the utmost confidence and return on your capital modeling efforts.